When the New Year bells ring, finances are typically at the top of the resolutions list. It can be exciting and empowering to want to achieve your financial goals once and for all. However, what most people fail to realize is that you must strengthen those financial muscles first. It’s just like setting a fitness goal: you don’t set out to run a marathon without also changing your eating habits, sleeping habits, and workout habits. It’s the shift in these small habits that gets you prepared and moving towards your goal. The same is true for finances. If you intend to pay off your debts or save for that home in the coming year, you need to ensure that you are making changes to your everyday financial habits as well.

1. Create a Budget

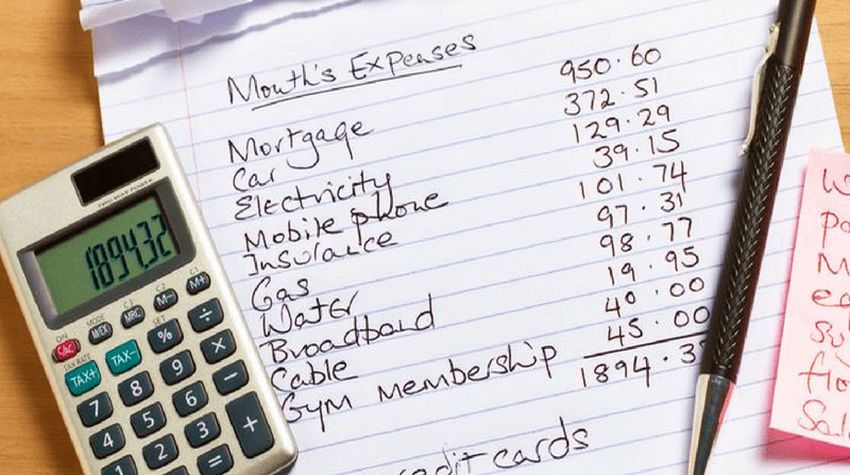

It might be hard to hear this, but creating a budget is one of the best financial habits that you can have. Managing your money starts with knowing where your money is going, and without having a proper budget it can be quite easy to lose track of your monthly spending. How many times have you asked yourself, ‘Where did my money go?’ Creating a budget provides the clarity and control you need to stay on top of your finances.

Keeping a budget ‘in your head’ is not wise. We can hardly remember what we did last week, so how do you expect to remember all the places where your money has gone? Create a well-formed budget by pulling together at least the last 6 months of all banking transactions. Use that data as a basis for how you would like to spend your money going forward. Be sure to include your savings goals and debt repayment goals within your budget as well. A budget is meant to capture your entire financial picture and should show how all your monthly income is being allocated.

2. Check in With Your Money

Having a budget is one thing, but using it is another. Most people fall into the trap of only looking at their finances at the end of the month, which makes it difficult to adjust spending before it’s too late. As with any major plan or project, there are check-in points. The same is true for your finances. Setting up weekly money meetings is important to ensure you stick to your budget and achieve your financial goals. Set up a time each week to track your spending and review it against your budget. Have you ordered delivery meals one too many times this week? Did you order another thing online that was not planned? Put a plan in place for the upcoming week of the changes that need to be made to avoid running over your budget.

Having a pulse on your finances also allows you to be financially proactive instead of reactive. By knowing how your money is allocated, you can easily adjust and adapt in the event of any unexpected circumstance. This is how you remain in financial control.

3. Say No

This might be one of the hardest habits to develop, but it’s the most powerful. If you have gotten into the habit of saying yes to you, your kids, and your family, it might be time to release that habit now. Achieving your financial dreams starts with being financially responsible and that means sticking to your plan, living within your means, and saying ‘No’ to anything that is outside of your plan.

Don’t go on this journey alone. Make sure you have communicated your new financial focus to your family. Have a family meeting to discuss your financial goals and priorities, share your budget and let your family know upfront that spending will be different this year. Tell a trusted friend about your commitment and ask them to keep you accountable. And, when you find yourself tempted to give in, remember why you started on this journey to begin with.

4. Build Your Emergency Fund

If there is anything that is certain, it’s that life is uncertain. You never know when life might send you on an unexpected path, so you must always ensure you are financially ready and prepared. This is where having an adequate emergency fund can help you to maintain financial security. Whether it’s losing a job, the car breaks down or the furnace needs to be prepared, life always seems to happen. In these circumstances, most people use their credit cards or line of credit to make it through but having an emergency fund ensures you avoid this debt spiral.

The goal should be to have 6 to 12 months of your income saved in an emergency fund. Calculate how much that would be for you and your family and then develop the habit of savings towards this goal each month. You can create your own financial security if you prioritize this one important financial habit.

5. Stop Celebrating the Minimums

Paying the minimums on your credit cards is no reason to celebrate. If you are serious about getting out of debt, you will need to create the habit of paying more than what is due. If becoming debt-free is a meaningful goal for you, then you must take it a step further and create a debt repayment plan. A goal without a plan is only a wish, and wishing your debts away is not going to cut it. Look at your budget and see how much excess cash you have after all your expenses. Reduce or eliminate any unnecessary expenses. Determine how much money you can put towards your debts each month and then create a plan to do just that. To ensure you stick to the plan, set up automatic monthly debt payments so that the money is actually paid to your debts before you can spend it.

And while we are on the topic, also make sure you pay all your debts on time. This can greatly impact your credit score which needs to remain intact should you ever wish to leverage credit for significant purchases such as a home or a car.

Implementing these habits will create a more stable and secure financial future for you and your family.