Have you ever been surprised to find that you were turned down for credit, or that you had very little credit history at all? Even if your credit history is rock solid, it’s important to know what goes into determining your credit score. Understanding how your credit score is measured will help you improve it and keep it in good standing.

What is a Credit Score?

A credit score is a summary of an individual’s entire credit history and serves as an indicator of their ability to meet their financial obligations. Your credit file is a fairly complex document that’s full of various codes and data. The credit bureau provides an ongoing analysis of that data, summarizing it into an easy-to-decipher 3-digit score, allowing lenders to assess the overall quality of your repayment history, before deciding to dig deeper.

For example, an excellent credit score may indicate that no further investigation is necessary, an average score might suggest a deeper review, and a poor one could mean a summary denial. In short, credit scores make life easier for the people and agencies we do business with, but not necessarily for us. Because of this, it’s important to keep a close eye on your credit score, so you can fix what’s broken before it becomes a problem.

How Important is Your Credit Score?

We generally tend to only think about credit scores when it’s time to borrow money. It might be for a car loan, a new credit card or credit card limit increase, or even a mortgage. Credit scores matter in the approval process of nearly any type of loan, but they can also affect the interest rate you pay. The best rates are usually reserved for those with the best credit scores. So, generally speaking, good credit scores translate into lower interest rates.

Other Uses for a Credit Score

But there are situations apart from borrowing, where credit scores are important. Employment is one. Prospective employers routinely pull credit reports on their new hires, often to determine if they’ll hire them at all. Insurance companies will run credit checks on new customers, and the resulting score can have an effect on the premiums they’ll pay.

Nowadays, just searching for an apartment to rent can result in your credit being checked. Running a credit report before approving your lease application has become standard procedure for many landlords and property management firms. Sooner or later, when you need that new loan, mortgage, or new apartment, the strength of your credit will become very important.

Who Keeps Track of Your Credit Score?

In Canada, there are two companies that maintain your credit score. One is Equifax, the other is TransUnion. Anytime a change is made to your borrowing account, your lender sends the information to Equifax and/or TransUnion. This could be to report a credit limit increase, a regular or late payment, or the payment of your account in full.

Some lenders will send your information to both credit bureaus, some only deal with one or the other. For this reason, your credit score can vary between Equifax and TransUnion. Both companies also use a slightly different algorithm to determine your score, which can also result in a slight variance, although it’s not usually significant. While you have little control over which credit bureau your lender chooses, it’s important to be aware that there are more than one, and that either (or both) could be used.

What’s Considered a Good Credit Score?

Now that we know who measures your credit score, and why it’s so important, let’s take a look at what is considered a good score in Canada. Because the parameters have changed somewhat in recent years, it’s not always clear what is considered a good credit score anymore.

Let’s take a look at the different levels, and how they are categorized:

- Excellent = Score of 800 or above

- Very Good = Score between 720 and 799

- Good = Score between 650 and 719

- Fair or Average = Score between 601 to 649

- Poor = Anything below a score of 600

How to Interpret Your Credit Score

So, what do these different levels mean? For example, what’s the difference between having a good score and a very good score? The impact of your credit score on an application can vary, but with all else being equal, we can draw some general conclusions from the categories described above.

If your credit score is above 800, for example, you likely won’t have any difficulty obtaining credit, and the lender will often provide an approval quickly, without requiring additional documentation. Between 720 to 799 (very good), approval is still very likely, but you may not qualify for the best rates the lender can offer. If your score is good (between 650 and 719), you may not qualify for certain products, depending on where your score falls in the range. For example, some premium credit cards have a minimum credit score requirement for approval. If your score falls below 650, most lenders will want to dig deeper into your credit history, to find out why the score is not as strong.

Based on what they find, they may decline your application, or require you to provide a co-signer or additional security. Generally speaking, a credit score of less than 600 (poor) will be insufficient in order to obtain a mortgage. There are lenders who will consider your application; however, you may be subject to much higher interest rates.

As you can see, a higher credit score means greater flexibility, and freedom when borrowing. Not only does it make it easier to be approved for a loan, a job, or an apartment, but an excellent credit score will also mean that you’ll pay less for whatever it is you’re buying.

Tips for Improving Your Credit Score

If you want to improve your credit score, there are a number of things you can do. Here are some tips that can help you better your credit score, with the first one being the most important:

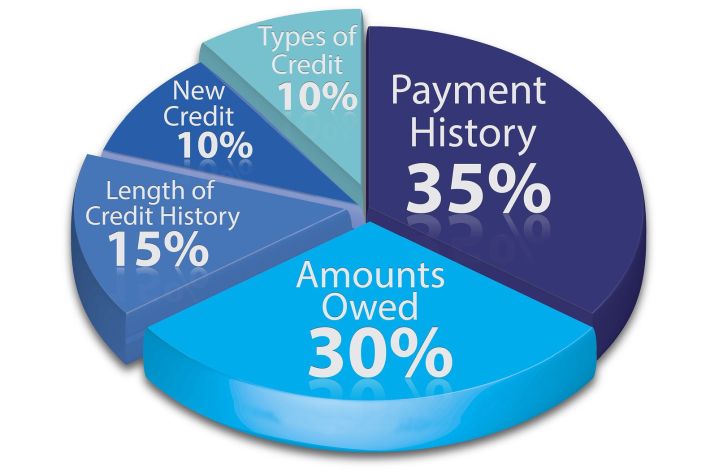

Pay Your Bills on Time

Your ability to repay your loans is the most telling aspect of your credit score. Late payments are recorded and stay on your record for several years. If you pay late repeatedly, you are likely to see a rapid decrease in your score.

Keep Your Balances Low

Don’t max out your credit cards, or lines of credit. When you are close to your available credit limit, it sends up red flags and can lower your score. If you cannot pay off your credit card in full every month, try to keep the balance below 50% of your credit limit. A high credit utilization ratio will lower your overall score.

Build Credit History over Time

The further back it goes, the better. A long credit history (if it’s a good one) will strengthen your score. Think twice about closing a paid-off credit card that you no longer use if it’s your earliest source of credit.

Hold Various Types of Credit

You don’t want all of your credit to be in one category. Mix it up a little. Credit can include credit cards, lines of credit, car loans, RRSP loans, and mortgages. The variety of revolving credit and installment credit can help reinforce your credit history and show that you can handle different credit situations.

Only Apply for Credit You Need

Every time you apply for a credit product, your score drops ever so slightly. The more credit inquiries you have in your recent history, the more credit hungry you look, and the lower your credit score will be.

Check Your Credit Report Frequently for Errors

With so many parties reporting your credit information to the bureau, a simple keystroke error could result in a late payment being recorded where there was none. While it’s possible to dispute the information and get the lender to change it on your credit report, the process can be a real hassle. You should check your credit report periodically for errors.

Following the above steps should help you improve your credit score, however, be patient, as it can take time. You may need 60 days before seeing any improvement, and it could take longer than four months to see substantial improvement.

You Need to Use Credit to Get a Credit Score

You may be very responsible with your finances. You don’t use credit cards, always preferring to pay with cash. If you are living debt-free, then you may find that your credit score isn’t as good as it could be, and it could mean a higher interest rate on loans you are approved for.

If you don’t make use of credit, then there is no payment history with which to establish a score. And although debt-free living is beneficial in many ways, it, unfortunately, won’t help your credit score. Since the most important factor is your payment history, you need to be making payments on something in order to have a good score.

What Is a Good Credit Score in Canada and Why it Matters?

Maintaining a good credit profile is an important part of your financial health. And while there are many things to consider, the most important step you can take is to make all of your payments on time. As for your actual credit score, higher is better, but you don’t need to have a score over 800. As long as your score is over 700, you’re unlikely to be denied credit due to the score itself. If your average credit score is below 700, there are steps you can take to improve it.

Look after any unpaid collection items or judgements that are impacting your credit. If you have accounts that are in arrears, it’s important to bring them up to date as soon as possible. If you have revolving credit, such as a line of credit or credit card, make sure you are at least making the minimum payment each month. Failing to do so will impact your credit score negatively. If you’ve never ordered a copy of your credit report, you can sign up through Borrowell or Credit Karma and get your free credit report. If you do, you’ll be well on your way to building a strong credit history.