Faced with high inflation and rising interest rates, more Canadians are finding it difficult to qualify for a mortgage. The problem can seem even worse if you struggle with poor credit. The good news is that even if your credit history is less than stellar, you may not have to put off buying a home, although you will likely pay more for your mortgage.

Do You Know Your Credit Score?

One of the biggest mistakes people make before getting a mortgage is not knowing their credit score before applying. Recent reports have revealed that more than 50% of Canadians have never checked their credit scores. If you’re only finding out that you have bad credit when you apply for a mortgage, it may be too late to do something about it.

What is a Good Credit Score?

While lenders can set their own minimum credit score guidelines, the following generally applies:

- 800 or above: Excellent

- 720 to 799: Very Good

- 650 to 719: Good

- 600 to 649: Fair or average

- Under 600: Poor

To obtain a mortgage with a Prime lender (banks and credit unions), you will likely require a credit score of 600 or higher. In fact, any mortgage with less than 20% down must also be approved by Canada’s mortgage default insurance providers, i.e., CMHC, who require at least one borrower to have a minimum credit score of 600 or higher. If your score is below 600, you will most likely need to deal with an alternative or private lender, come up with a 20% down payment, and be subject to a higher mortgage interest rate.

How to Get a Mortgage with Poor Credit

If you struggle with a bad credit score, there are still ways to qualify for a mortgage loan:

Increase Your Down Payment Amount

If you have bad credit, you can improve your chances of being approved for a mortgage by coming up with a larger down payment. While it’s possible to obtain a mortgage in Canada with as little as 5% down, if your credit score falls below 600, you won’t qualify for mortgage default insurance, and a 20% down payment will be required. A larger down payment has other benefits as well. By avoiding the hefty CMHC premiums, you will save thousands of dollars during the life of your mortgage.

How to Find More Money for Down Payment

- Gift from a family member. You can receive a part, or all, of your down payment as a gift from a family member. The lender will require them to sign a gift letter to confirm that the funds aren’t borrowed and that there is no expectation of repayment.

- Withdraw RRSP funds under the Home Buyers Plan (HBP). If you are purchasing your first home, the government of Canada has a program that allows you to withdraw funds from your RRSP to use towards your down payment. The current withdrawal limit is $35,000. You will have to repay the amount you withdraw into your RRSP, but you have 15 years to do so, beginning in the second year after the year in which you removed the funds.

- Delay your mortgage application. If you have tapped out all potential down payment sources and are still short, you may have to delay your mortgage application while you save more money. Can you hold off for six months or a year? Consider a side hustle to increase your income and your savings rate.

Improve Your Debt Servicing Ratios

In addition to having an adequate down payment and credit score, mortgage lenders must determine if you can afford to make the monthly mortgage payments. To do this, they use two calculations, Gross Debt Servicing (GDS) and Total Debt Servicing (TDS).

Your total debt servicing (TDS) measures your total monthly obligations as a percentage of your gross monthly income. This includes your mortgage payment (PIT) and any other loans or credit card payments you might have. Your TDS ratio should not be more than 40%, although lenders may accept TDS as high as 44%.

You can increase your approval chances by lowering your TDS. There are a few ways you can do this:

Increase Your Income

I alluded to this earlier but consider ways to increase your income. The easiest is to make more money at the job you already have, by asking for a raise, or getting promoted. If that’s not an option, think about a second job, keeping in mind that a mortgage lender will require you to be off probation before they can use your income for debt servicing purposes. Side hustle income is also great, but it likely can’t be used to qualify for a mortgage.

Pay Down Existing Debt

To improve your mortgage affordability, think about ways to free up cash flow by reducing your debt load. Among the worst culprits are huge vehicle loan payments, which have surged to record levels in recent years.

Avoid Taking on Additional Credit

You’ve heard the saying, “An ounce of prevention is worth a pound of cure.” It’s easier to say NO to more debt than dealing with the debt you already have (like that massive pickup truck loan.) If you’re in the market for a mortgage, it may be best to avoid taking on other debt. If you do, ensure it will not impact your chances of being approved for the mortgage.

Go Through a Private Mortgage Lender

If your credit is so bad that no A or B lender is willing to approve your mortgage application, talk to your mortgage broker about going through a private lender. Private lenders aren’t just ‘bad credit mortgage lenders.’ While they do a lot of bad credit mortgages, they also lend to borrowers who may have decent credit but whose application falls ‘outside the box’ of a bank or credit union.

Your broker will bring up the private lender alternative before you do. Understand that private lenders charge much higher interest rates than A lenders, but the idea is to deal with them for a year or two and then move the mortgage to a prime lender.

Obtain a Co-Signer

If your credit score prevents you from getting a mortgage, another option is to obtain a co-signer. A co-signer must have very strong credit, a solid net worth, and enough income to support the mortgage on their own should the primary applicant fail to make the payments.

The downside to obtaining a co-signer is that it ties you to that person financially, potentially for several years, in the case of a mortgage. It can also be challenging for the co-signer themselves, as they must include your mortgage PIT whenever they apply for credit, even though they are not making the mortgage payments. For these reasons and more, I don’t recommend using a co-signer, except in rare instances. But it is an option.

Improve Your Credit Score

Ultimately, if your credit score is standing in the way of getting approved for a mortgage from any lender, your only other option is to address your low credit score. And while it won’t happen overnight, there are several steps you can take to improve your score.

How to Improve Your Credit Score

If you are struggling due to poor credit, there is hope. Here are seven steps you can take to improve your credit score.

- Pay off any unpaid collection items. If you have unpaid collections showing up on your credit report, you need to settle them as quickly as possible. These are debts in such high arrears that the lender has sent them to a collection agency to pursue repayment. Generally speaking, no bank or credit union will lend money to someone with unpaid collections showing on their bureau. If you have multiple collection items, I recommend that you start by paying the lowest balance owed first.

- Pay your bills on time. If you have bad credit, continuing to make late payments will only worsen matters. Take steps to ensure timely payments going forward. Remember that most companies report late payments as soon as they are 30 days in arrears.

- Avoid making excessive credit inquiries. Each time you apply for credit, it counts as an inquiry on your credit report, and your credit score could drop as much as five or ten points, albeit temporarily. If your account shows multiple inquiries over a short period, say six to twelve months, potential lenders may view it as evidence of credit-seeking behaviour, and cause for concern.

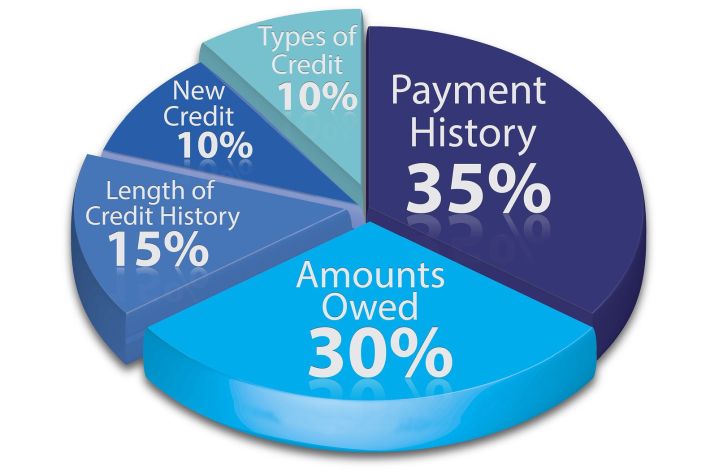

- Keep Your Credit Utilization to a Minimum. Credit bureaus, like Equifax and Transunion, keep track of your credit utilization: the percentage of available credit you’re using. For example, if you have a credit card with a $10,000 limit and you carry a balance of $5,000, your utilization is 50%. When your credit utilization exceeds 30%, it’s a sign that you might struggle to manage your credit. Credit utilization is a determining factor for your credit score, so try to pay off balances in full, or at the very least, keep them under 30%.

- Don’t close longstanding credit accounts. One of the things that strengthen your credit score is the length of time a credit product has been reported to the bureau. When you close a longstanding credit card or line of credit, it may shorten your history and lower your score. And while it’s often beneficial to reduce the number of credit cards you hold, think twice before closing a longstanding account. If you feel like it’s the best choice, wait until after your mortgage application has been approved and finalized.

- Check your credit score regularly. What gets measured gets managed, but it could also be stated that what gets measured gets improved. If you check your credit report regularly, you can take corrective action if you notice any downward trends. You can also proactively correct errors and check your account for fraud.

How Do I Find a Lender Who Will Approve My Mortgage?

If you’re looking for a mortgage and are concerned about your credit score, your best bet is to consult a mortgage broker. Mortgage brokers have access to dozens of lenders, not just the big banks. They can shop your application to alternative and private mortgage lenders, in addition to the banks and credit unions, giving you the best chance for approval.