As parents, it can be overwhelming to think about everything we need to teach our kids — whether it’s showing them how to cross the street safely, introducing them to the alphabet or teaching them to ride a bike. Unfortunately, money still seems to be a taboo educational topic — even among families. Teaching your kids about money lessons is essential for raising adults who are comfortable talking about and handling their finances. By following these tips, you can create a solid financial foundation for your kids.

1. Talk About Family Finances

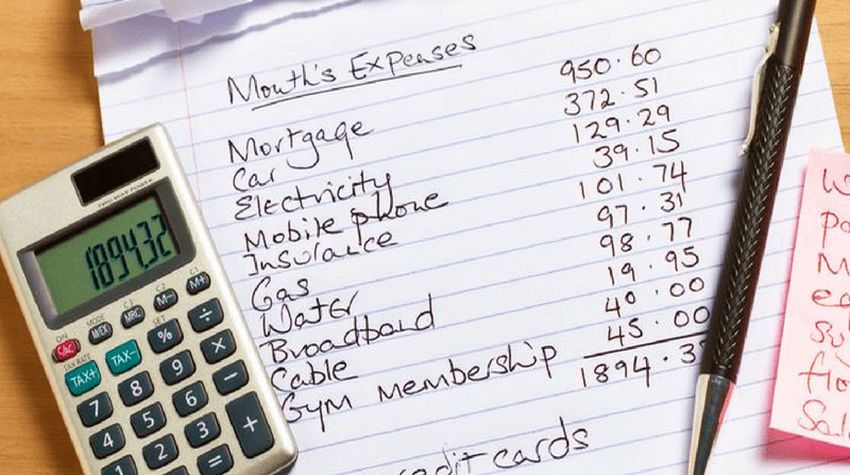

We’re not suggesting that you study your financial spreadsheets with your kids for a family fun night, but your children can’t get comfortable talking about money until they know you’re comfortable talking about it. By setting up a consistent family budget meeting — you don’t have to call it that if the b-word scares/bores everyone — your gang can get in the habit of discussing topics like how much money it takes to keep your household functioning and why it’s important to plan for big purchases.

If kids get the opportunity to give their input — and no, they don’t get the deciding vote, even if they outnumber you — it will empower them to take responsibility for how the household spends its money. It can start with something simple like: We have $50 extra spending money this month. Would you rather go to a drive-in theater or save the money so that next month we could go on a camping trip?

2. Show Them Why Saving Pays

Your child’s method of saving will evolve as they get older but teaching the basic value of setting aside money will help them avoid the temptation to make an impulse buy each time they have money in their hands.

Use Real Dollars & Coins

Using physical cash and coins is great for helping younger children understand the concept, as it allows them to see how their nickels and dimes (and dollars) can really add up. You can start out by teaching kids to budget their money — consider using one piggy bank for savings, another for spending and a third for giving.

Open a Bank Account

When they’re ready, you can take the next step by opening a bank account for your child. Many banks have accounts specifically for minors if their parents also bank there, which can help your children save on fees that banks may charge for regular accounts.

By bringing them along to a physical location to open their bank account, you’ll help your kids become more comfortable dealing with financial tools and institutions. That way, banks won’t seem as intimidating when your kids open their own accounts as adults.

Teach Them About Compound Interest

Additionally, use their savings accounts as an opportunity to teach kids about compound interest — a basic financial concept that explains how your money can grow by earning interest on the interest.

3. Let Them Learn the Value of Their Money

Getting your children to value their money can give them a head start on money management skills. It starts with understanding where the money comes from (the ATM doesn’t count). Whether you pay them an allowance, they receive money as gifts from relatives or they’re making their own money (yes, even a lemonade stand business counts), your children will better understand how much a dollar is worth if they learn how to budget their money early on. Accounting for each dollar allows a child to learn decision-making skills that will prepare them for later in life when they’re parcelling out their paycheck.

Ask them questions like: Is it worth doing an extra chore to have their pick in the candy aisle at the grocery store? By giving them the power to make that decision, your children will be able to apply the same money concepts when deciding as an adult whether it’s worth working an extra shift to buy those new shoes or taking on a side gig to pay to build an emergency fund.

4. Don’t Let Investing Be Only for the Rich

Your kids don’t need to become the next Warren Buffett to learn the value of investing. And they don’t need to be rich to start (and neither do you). No matter what their age, kids can learn about growing wealth by investing a small portion of their money. We recommend starting with a very small amount since there is, of course, a risk that their investment could lose value. It’s a tough lesson, but one that’s easier to accept if your child lost a week’s allowance rather than a lifetime savings.

And investing doesn’t require a large cash outlay to start, especially if you work with a brokerage that allows you to open a custodial account and invest in fractional shares. For just a few dollars, your kids can pick a couple of companies that make their favorite toys or movies, then check the stock price each week to see how their investment is faring. If your family is the competitive type, let every member invest in a different stock and see whose stock grew the most at the end of a year.

5. Don’t Make Debt a Four-Letter Word

You want to protect your kids from all the bad things, so if you don’t talk about debt, they won’t end up in it, right? Maybe. But probably not. Giving them the tools to understand debt is a better way to avoid bad debt and responsibly handle the good debt that they’ll face in their lifetime.

Differentiate Good Debt vs. Bad Debt

So how can you teach kids the difference between bad and good debt? Remember these two factors:

- What’s the interest rate?

- What’s the value of the item they’re going into debt for?

As a general rule, if you’re borrowing money at a higher rate than you can earn by investing, that’s bad. For example, if a credit card charges 18% interest, you can’t reasonably expect to get those kinds of returns on investments, so that’s a bad debt. However, if you get a mortgage with a 3% interest rate, there’s a good chance you could invest that money and make more in interest.

It’s also important to teach kids that bad debt vs. good debt involves the types of things and events that they’d want to use the credit for. Borrowing money to buy a candy bar? Bad debt. Borrowing money to invest in a mower so you can start making money cutting the neighbor’s lawns? Good debt (since they’ll in theory be using that borrowed money to make more money).

Get Real About Student Loans

One of the biggest decisions kids will have to make early on in regard to debt is whether to take out student loans. Start talking to your teens early about how student loan debt could affect their lives after college. Although it can be a very personal decision, encourage them to consider the costs and benefits of student loan debt. For instance, is the private, out-of-state school with the gorgeous campus worth the debt burden if they’re getting an education degree? Teaching your kids early about how to use debt and credit lines responsibly — perhaps by adding them as an authorized user — will let them see the benefits of building a solid financial foundation.

Start Small

And if all this is a little much for your youngest kids to understand, you can introduce this money lesson with one of these debt free charts. Start by deciding on a bigger purchase your child wants but doesn’t have enough cash for yet — but small enough that they can “pay it off” in a few weeks or months. Each time they make a “payment” to you, they can color in another section of the chart. By the end, they’ll have a better understanding of what it means to pay off debt, and you’ll have another piece of art to hang on the refrigerator. Win-win.