Three little digits can make a big difference when you’re trying to get a mortgage you can afford. Whether you can land a mortgage with a low interest rate or even get any home loan at all often comes down to three little digits: your credit score. Does your credit score need some help? And could it keep you from buying a home? Let’s find out.

How do credit scores work?

Canada has two main credit bureaus — Equifax and TransUnion — that collect and share data about how you’ve used credit in the country. These private companies draw up credit reports that summarize your activity and use it to assign you a credit score. Lenders like banks rely on your credit score to tell if you’re a good investment.

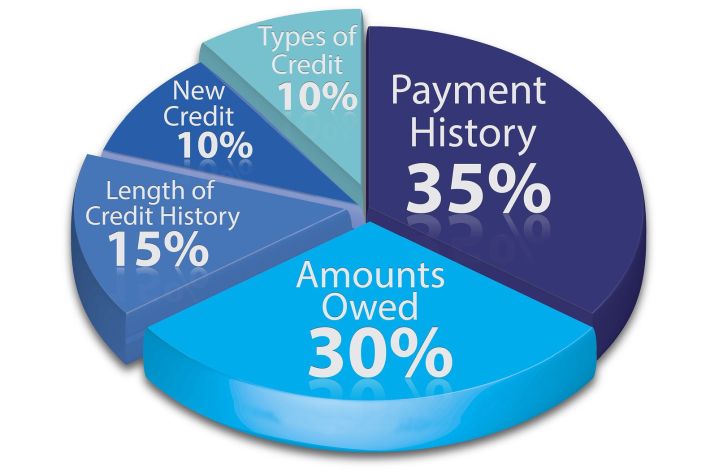

Credit bureaus assess a lot of information in their reports, such as:

- How long you’ve had a credit card

- Whether you miss payments

- Whether you stay close to your credit limit

- The number of times you apply for credit

- The size of any outstanding debts

Credit scores range from 300 to 900 and they play a big part in being approved for a mortgage. A higher score means you’re managing your credit well and making payments on time. A lender will be more likely to let you borrow their money. A low score suggests you’re a risk, so you could be refused outright.

When your credit score is decent but not spectacular, a lender will compensate for that risk by saddling you with a higher mortgage rate. A higher interest rate means a higher monthly payment and steeper total interest charges over the life of the loan.

How do I know if my score is too low?

Plenty of third-party services and a few banks will give you a free look at your credit score online. Other companies will ask you to sign up for a paid service that may have other benefits, like credit monitoring and support. According to Equifax, most lenders smile when they see a score of 660 or higher. Anything above 760 is excellent. Anyone with a score below 560 will struggle to get a decent interest rate and may not get a loan at all.

Each lender has different standards, and those standards can change depending on what’s happening in the mortgage market. Some private lenders won’t be as demanding as major banks but may offer far worse deals to compensate. These “subprime” lenders work almost exclusively with people who have low credit scores.

If your credit score needs work, you’ll want to carefully consider whether the cost of a higher interest rate is worth it. You may decide it’s better to delay your home purchase to give yourself time to improve your score.

How do I raise my score?

The easiest way to bring up your credit score quickly and snag that mortgage is to obtain copies of your credit reports from the major credit bureaus and make sure everything on them is accurate. Canadians are entitled to a free look at their credit report at least once per year from both Equifax and TransUnion. If you find any mistakes, dispute the errors so they can be removed.

Paying bills on time, even if it’s just the minimum payment, is one of the most important factors. Contact your lender right away if you fear you might miss a payment, and don’t skip a payment even if it’s in dispute.

Try not to use too much of your available credit. The federal government suggests using a third or less of what you could be using, even if you always pay off the balance. Paying down your credit cards to cut your credit utilization can give your credit score a nice boost.

Another option is to enroll the help of a free credit monitoring service. You’ll get instant access to your score and be able to check your credit history regularly. You have a few other options — like using different types of credit rather than just credit cards, keeping old accounts active and trying to limit the number of credit checks — but these basic steps will put you well on your way to home ownership.