10 Budgeting Tips to Help You Stay on Track

A monthly budget is like Google Maps for your finances: you follow it because you don’t know where you’re going without it. If you’re new to budgeting, don’t be discouraged by a few — or many — wrong turns and closed roads along the way. The longer you stick with it, the better you get. With a few simple budgeting tips, you can be well on your way before you know it.

1. Set Your Goals Before You Make Your Budget

Without a goal, a budget is just a spreadsheet that tells you to have less fun. Think about what you want in the next 5 to 10 years and figure out what financial situation you need to get there. Whatever your goals are, know that any sound financial foundation starts with an emergency fund. You might then want to pay off debt, save for a down payment on a home, or increase your savings.

Decide where you want to be financially next year and the year after. Knowing what you want to do with your money will guide you as you figure out how to budget, and it will greatly increase the likelihood that you’ll stick to it.

2. There’s No One Size-Fits-All Budget — Find a Plan That Works for You

There are so many budgeting methods out there, and every guru says theirs is the best. But ultimately you have to choose the one that works for you.

If you’ve got an ambitious goal, we recommend trying a zero-based budget first. To make a zero-based budget, start by prioritizing your expenses from essential to nonessential. Then, assign every dollar in your paycheck a “job” on the list until you run out. The most important things — housing, food, minimum debt payments — get taken care of first, and you can disburse the remaining money for your goals and fun in their order of importance to you. Zero-based budgeting is great for ‘Type A’ planners.

If you prefer to be a little more loosey-goosey, a 50/20/30 budget is a great option. With this approach, you don’t have to think too much about your expenses. You just allocate 50% of your income to your needs, 20% to savings and 30% to wants.

3. Use a Budget App or Envelope System to Track Your Spending

It’s hard to lug around your laptop or binder to keep up with each budget category, so a budgeting app is a great tool for updating your budget on the go. There are many out there, whether you like to enter each transaction manually or see everything updated automatically.

If your goal is to take an intense look at your spending, manually tracking your transactions is going to work best. Once you’ve been budgeting for a while and you’ve got a grasp on your spending, syncing transactions automatically works fine. If you still can’t stick to your budget, the envelope system can help you succeed without so much emphasis on constant tracking.

After you decide how much money goes toward each of your expenses, put the money you’ll spend for each expense in a given week into separate envelopes and carry them with you. Once an envelope is empty, you’re done spending in that category. You can keep receipts in the envelope and examine your purchases later.

Envelopes are best for categories you’re prone to overspending on. You probably don’t need envelopes for things like gas and utilities because you’re not likely to go on a gas-buying spree. Popular categories for envelopes are restaurants, groceries, clothes, and entertainment.

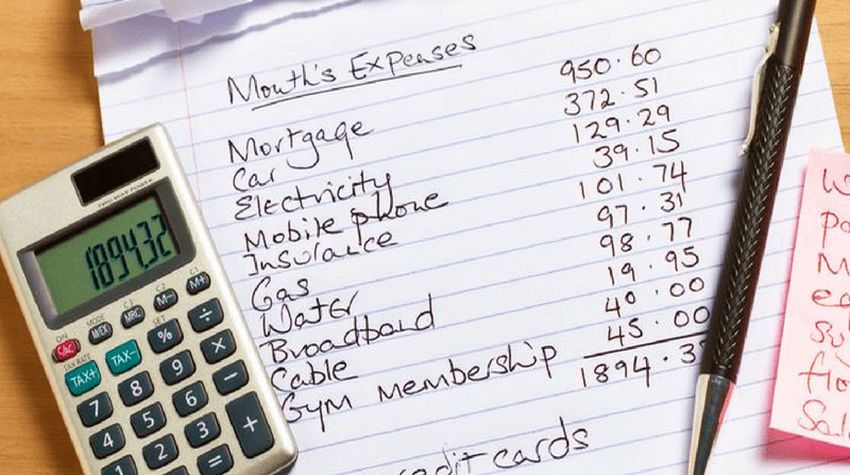

4. Use the Past to Predict Your Future Income & Expenses

Whether you choose a zero-based budget, 50/20/30 budget, or some other method, you’re going to have to calculate your income and the amount of money you want to put toward every category or individual expense.

Salaried employees will get off easy when they calculate their incomes. If you have a variable income or side hustles, you’ll need to do some digging. Look back at your income from the past six months, or as far back as you can if you’ve been at your current job for less time. Then find your average monthly income and the average amount of each paycheck.

Expenses like utilities can also be unpredictable. Check your online statements to see which months were higher versus which were lower so you can make future budgets. You may not be able to take that impromptu weekend getaway the month your electric bill will be $300, but it might be totally feasible during a month it’s going to be $75.

5. Don’t Confuse Infrequent Expenses with Emergencies

These aren’t the unexpected expenses that you’d cover with your miscellaneous or emergency categories. Infrequent expenses are the charges that come up once or twice a year — but we always seem to forget will happen. Like when it’s December 23 and you’re still not done with your holiday shopping. Who could’ve predicted Christmas would be on December 25 again?!

Keep a chart that includes your semi-annual and annual expenses to determine what you need to save every month to cover them. Open a separate checking account or savings account where you put money every month to cover these expenses.

6. Remember the Obvious: You Need to Spend Less

Count this among the budgeting tips no one wants to hear. Once the planning is done, it’s time for the hardest part: sticking to your plan. If you’re in the habit of spending more than you make, your first priority is to find ways to save money. We don’t mean you need to find better sales and clip more coupons. The most important thing you can do is buy and spend less.

Some of good tips to cut spending are:

- Make a meal plan and stick to your grocery list

- Prep meals on Sundays so you’re less likely to eat out during the week

- Treat yourself to a coffee once a week instead of daily or cut them out completely

- Opt for free events in your area instead of pricy activities or bars

- Try running and body-weight workouts instead of paying for a gym membership

There are countless ways to save money. Do everything you can to resist the temptation to make impulse purchases or spend beyond your budget. An easy way to do this: Leave your credit card at home and use cash envelopes or a debit card.

7. Use the 30-Day Rule to Stop Impulse Shopping

If you still need to curb impulse shopping, follow the 30-day rule: When you want to buy something that’s not in your budget, make note of the item in question for next month’s budget and revisit it in 30 days. If you still want it, you can consider buying it if you can afford it.

8. Negotiate Your Bills to Save Money

People often take for granted that what they’re paying for their phone, internet and insurance is what they have to pay. By contacting your providers to negotiate your bills, you could lower your bills once or twice every year.

9. Remember That Things Will Go Wrong

Student loans and credit cards aren’t paid off overnight. And the perfect budget isn’t made in a day. Things will change and go wrong. Impulse purchases will be made, and budgets will get obliterated by life’s little surprises. The most important tip for budgeting is to not give up. When things go wrong, alter your budget to compensate. Move money from one category to another, put less in savings, or try a side hustle to add some wiggle room. And know that sometimes you’ll find yourself ripping up the entire budget and starting again from scratch in the middle of the month. Eventually, you’ll get this whole budgeting thing down. But it’s going to start with some bumps in the road.

10. Have an Income-Sinking Fund for When Your Income is Lower

Living off tips, sales commissions or freelance work can make for a flexible lifestyle, but it also makes it hard to budget. When you have an inconsistent income, you can follow all the budgeting tips above, but having this additional category may help.

When you calculate your income and get your monthly average, compare it with your income each month throughout the year. In months you expect to make more than average, take the difference, and transfer it to your income-sinking fund. It’s a separate account where you put money you plan to take out in the near future for a specific purpose, such as supplementing your income on low-earning months. During months when you expect to make less, you can withdraw up to your monthly average to help with expenses.

The key to any good budget is consistency!