We never know what the future holds for us, so it’s always best to be prepared. Having an emergency fund is extremely important so you’re always prepared to deal with what life brings—good or bad. It’s a good idea to make an emergency fund one of your highest savings priorities. Put $20 a week in an emergency fund and your account will grow to over $1,000 in just one year. That’s often enough to cover a repair bill or emergency travel. An emergency fund can also shield you from the high cost of borrowing and keep you from sinking into debt. Follow these five tips to help you set goals and take steps toward starting an emergency fund:

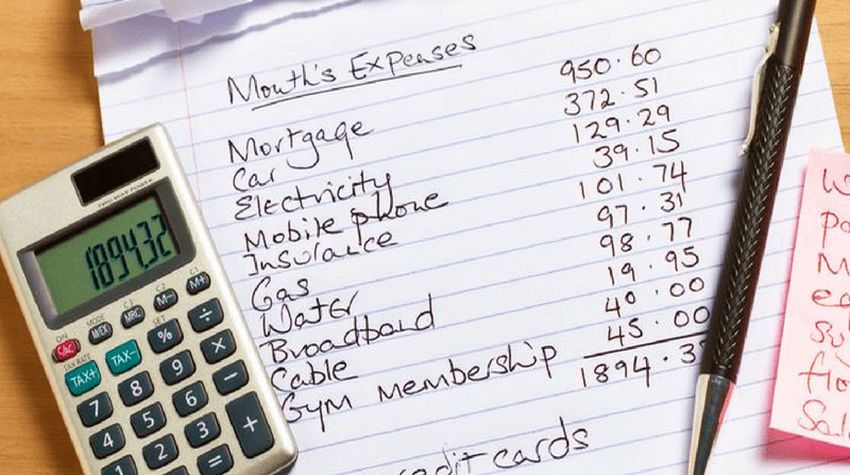

Chart your monthly income & expenses. Grab a piece of paper and write down how much money your earn and how much you spend for each month. Be sure to include recurring expenses such as your rent or mortgage, utility bills, childcare, and estimates of other out-of-pocket expenses for things you might buy such as movie tickets, dinner out and clothing.

Set your emergency savings goal. An emergency fund should cover three to six months’ worth of realistic living expenses. If you feel your income is stable or have access to home equity or other forms of credit to use if needed, then you may be able to plan for the lower figure. If your credit is near its limit and your income outlook is less secure, you might want to save more.

Develop a plan to start saving. Setting a goal and developing a plan to achieve those goals go hand-in-hand. Part of your plan may include specific and measurable targets to work toward. For example, one specific goal may be to save an extra $300 over the next six months to put into an emergency fund.

Put your emergency fund in an accessible place. The best place for your emergency fund is in a liquid account (accounts where your cash is easily accessible). A liquid account might be a regular savings account at a bank or credit union that provides some return on your deposit and from which your funds can be withdrawn at any time without penalty. If you consider other options, like a certificate of deposit, money market fund or mutual fund, be sure to figure out how accessible your money will be in an emergency.

Stick to your plan. Once you’ve created your plan, make sure you stick to it. This can sometimes be the hardest part of saving for an emergency fund or any financial goal in general. If your goals are realistic and attainable, sticking to the plan will be much easier. A good way to stay on track is to save automatically. Set up a systematic transfer from your regular checking or savings account at your bank. Be sure to keep your rainy-day funds separate from your other accounts, and label it “for emergency use only.” Just writing down an account’s purpose can keep you from spending the money for any other reason.

Starting an emergency fund is a necessary building block for long term financial stability. Anyone can do it; you just need the right plan.