Like almost everything else in life, your response to money is largely dictated by your personality. But have you given much thought to how you behave in regard to your finances and how that behavior affects your bottom line?

Understanding your money personality is the first step and will help you shape your approach to spending, saving, and investing.

KEY TAKEAWAYS

- It may be useful to understand the various money personalities when finding the right approach to investing, spending, saving, and the overall management of your finances.

- Five common money personalities are investors, savers, big spenders, debtors, and shoppers.

- Debtors and shoppers may tend to spend more money than is advisable.

- Investors and savers may overlap in personality traits when it comes to managing household money.

- Big spenders and shoppers often have similar habits, but big spenders tend not to worry about debt, and shoppers may spend more time hunting for bargains.

The Five Money Personality Types

Character traits regarding money can be classified into specific groups. This subject has been analyzed in a variety of ways, and many people can identify with parts of several of these money personality profiles. The key is to find the type that most closely matches your behavior. The major profiles are big spenders, savers, shoppers, debtors, and investors.

- Big Spenders

Big spenders love nice cars, new gadgets, and brand-name clothing. People with a ‘spending’ personality type aren’t typically bargain shoppers; they are fashionable and always looking to make a statement. This often means a desire to have the latest and greatest mobile phone, the biggest 4K television, and a beautiful home. When it comes to keeping up with the Joneses, big spenders are the Joneses. They are comfortable spending money, don’t fear debt, and often take big risks when investing. - Savers

Savers are the exact opposite of big spenders. They turn off the lights when leaving the room, close the refrigerator door quickly to keep in the cold, shop only when necessary, and rarely make purchases with credit cards. They generally have no debts and may be viewed as cheapskates. Savers are not concerned about following the latest trends, and they derive more satisfaction from reading the interest on a bank statement than from acquiring something new. Savers are conservative by nature and don’t take big risks with their investments. - Shoppers

Shoppers often develop great emotional satisfaction from spending money. They can’t resist spending, even if it’s to buy items they don’t need. They are usually aware of their addiction and are even concerned about the debt that it creates. They look for bargains and are happy when they find them. Shoppers are varied in terms of investing. Some invest regularly through RRSP plans and may even invest a portion of any sudden windfalls, while others see investing as something they will get to eventually. Money personality traits are always not one-size-fits-all, and it may be possible for people to have overlapping characteristics when it comes to managing their finances. - Debtors

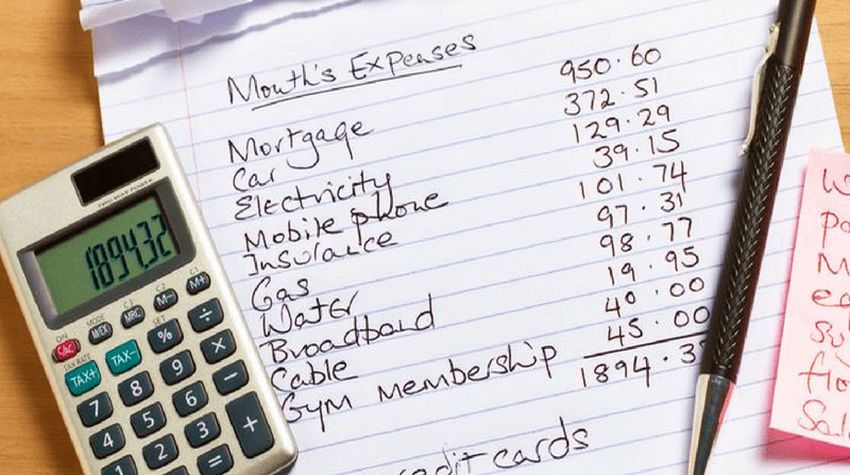

Debtors aren’t trying to make a statement with their expenditures, and they don’t shop to entertain or cheer themselves up. They simply don’t spend much time thinking about their money and therefore don’t keep tabs on what they spend and where they spend it. Debtors generally spend more than they earn and are deeply in debt while not putting much thought into investing. Similarly, they often miss taking advantage of the company match in their RRSP plans. - Investors

Investors are consciously aware of money. They understand their financial situations and try to put their money to work. Regardless of their current financial standing, investors tend to seek a day when passive investments will provide sufficient income to cover all of their bills. Their actions are driven by careful decision-making, and their investments reflect the need to take a certain amount of risk in pursuit of their goals.

Make These Changes to Your Money Personality

Once you determine which of these personality types describes you the most and have put some thought into how you approach money, it’s time to see what you can do to make the most of what you have. Making small changes can often yield big results.

Spenders: Shop a Little Less, Save a Little More

If you love to spend, it’s likely that you are going to keep doing it, but you should seek long-term value and not just short-term satisfaction. Before you splurge on something expensive or trendy, ask yourself how much that purchase is going to mean to you in a year. If the answer is “not much,” skip it. In this way, you can try to limit your spending to things you’ll actually use. When you channel your energy into saving, you have another opportunity to think long term. Look for slow and steady gains as opposed to high-risk, quick-win scenarios. If you really want to challenge yourself, consider the merits of scaling back.

Savers: Use Moderation

Ben Franklin once recommended “moderation in all things.” For a saver, this is particularly good advice. Don’t let all of the fun parts of life pass you by just to save a few pennies. Tune-up your savings efforts, too. Pinching pennies is not enough. While minimizing risk is any investor’s prime goal, minimizing risk while maximizing return is the key to investing success.

Shoppers: Don’t Spend Money That You Don’t Have

A critical step for shoppers is to take control of their credit cards. Unchecked credit card interest can wreak havoc on your finances, so think before you spend – particularly if you need a credit card to make the purchase. Try to focus your efforts on saving the money you have. Learn the philosophy behind successful savings plans and try to incorporate some of those philosophies into your own. If spending is something you do to compensate for other areas of your life that you feel are lacking, think about what these might be and work on changing them.

Debtors: Plan Your Finances and Start Investing

If you are a debtor, you need to get your finances in order and set up a plan to start investing. You may not be able to do it alone, so getting some help is probably a good idea. Deciding on who will guide your investments is an important choice, so choose any investment professional carefully.

Investors: Keep Up the Good Work

Congratulations! Financially speaking, you are doing great! Keep doing what you are doing and continue to educate yourself.

The Bottom Line

While you may not be able to change your money personality, you can acknowledge it and address the financial challenges that it presents. Managing your money involves self-awareness; knowing where you stand will allow you to modify your behavior to better achieve your financial and life goals.