Food waste is an invisible and expensive habit in our homes. No one wants to waste food, and no one walks into a grocery store and says, “Hey, I’m going to buy all this delicious food today and then throw it out next week.”

So if your fridge is filled with good intentions but you still manage to garbage your groceries, I’ve got the goods on how to prevent food waste and save up to $1,000 per year.

What is food waste?

Food waste is the forgotten food stuffed at the back of your fridge, the odds and ends that could’ve been a meal but you’re uncertain how to whip it into a recipe, lingering leftovers, and the packaged products a little past the so-called “Best Before” date. All these foodie situations could become food waste. Food waste is the food that’s ok to eat, but it’s being discarded, composted, or left to spoil without a plan to turn it into a snack or meal.

Food waste happens thanks to a chain of different (and expensive) behaviors starting with grocery planning, food shopping, meal preparation, leftovers, odd ingredients, and ending with everything in the trash or compost bin.

How much food do we waste?

I didn’t believe the number at first, so I asked a behavioral scientist who studies food waste to help out. Angela Cooper, PhD, an Associate at BEworks, says the problem is “pretty big”. Over $30-billion of food is wasted per year and about half of that is occurring in people’s homes. We might think it’s the restaurants or it’s the grocery stores, but we as consumers and as homeowners — we’re the culprits.

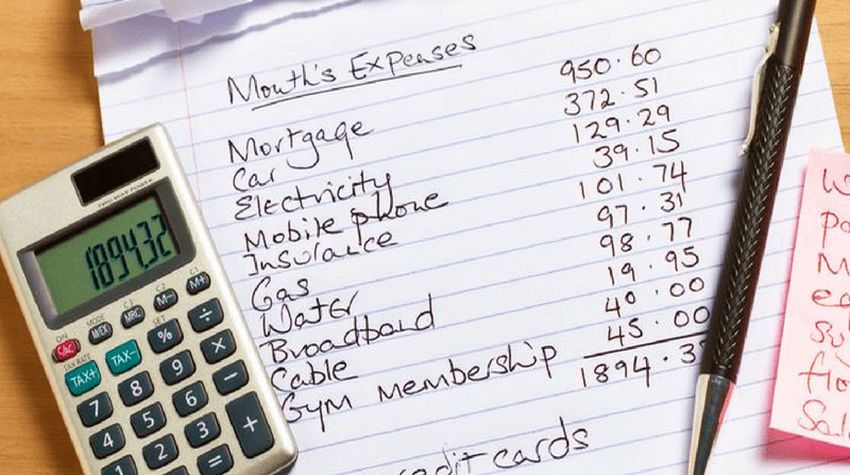

How much money is wasted?

Canadian households on average waste over $1,000 per year, says Cooper. That’s $92 a month, $21 a week, or $3 a day. The really tragic part is over 60% of that food is edible. This is what we call avoidable food waste — this is stuff that can be eaten — but maybe it just doesn’t look as nice, it’s a little bit shriveled or not the freshest looking, and this is what gets tossed. [This food] still has use, but a lot of people have an aversion to it.

How does food waste affect the environment?

Food waste has a massive environmental toll, says Cooper. In Canada, over two million tons of CO2 is produced from food waste which is about the equivalent of two million cars on the road. There’s been research that shows if food waste were a country, it would be the third largest CO2 emitting country in the world after China and the US.

How to prevent food waste?

BEworks, a behavioral economics firm, did a significant research study with Unilever Hellmann’s to help prevent food waste. After studying over 900 families, they found some very simple solutions that reduced food waste by 30% — saving families at least $300 per year.

Step 1: Place a Bowl in Your Fridge for “Food Recovery”

We all have ingredient odds and ends that get lost or buried in our fridge. Cooper says the simple act of using a bowl to collect a rogue celery stalk, half tomato, or apple slice “increases salience”, or in simple terms — hits you in the face when you open the fridge! The idea is if you see it, you’re more likely to use it.

Step 2: Pick a ‘Use-Up Day’

Pick one day per week to make a ‘Use-Up’ meal. Perhaps it’s the day before your next grocery haul, maybe it’s the beginning of the week or just a random day.

Step 3: The ‘3+1 Approach’ & a ‘Magic Touch’

So what to do with a bowl of odd ingredients? Here’s where the science of simplicity comes to play. BEworks and Hellmann’s found that giving families a simple formula for how to make a meal with food on hand made it easy to use it up.

They call it the ‘3+1 Approach’, where you bring together ingredients from three categories: a base (bread, rice, pasta), vegetable or fruit (pick one or a few), a protein of choice (chicken, eggs, tofu, beans), plus a ‘magic touch’ in the form of spices or sauce to bring the dish together and add flavour. This is designed to encourage people to substitute, swap out, and think a little bit more flexibly because recipes can be constricting. A wrap with chicken, lettuce, leftover bell pepper with tomato, and a dollop of hummus or mayo could be a 3+1 use-up recipe for lunch.

So grab a bowl, choose a ‘Use-Up Day’, and try the ‘3+1 Approach’ for a meal. Making these simple switches could reduce your food waste by 30% (or more) plus save you hundreds per year in trashed groceries.